U.S. spot bitcoin exchange-traded funds recorded their largest daily inflows in three months on Tuesday, signaling a return of institutional demand as investors rotated back into risk assets following year-end portfolio rebalancing.

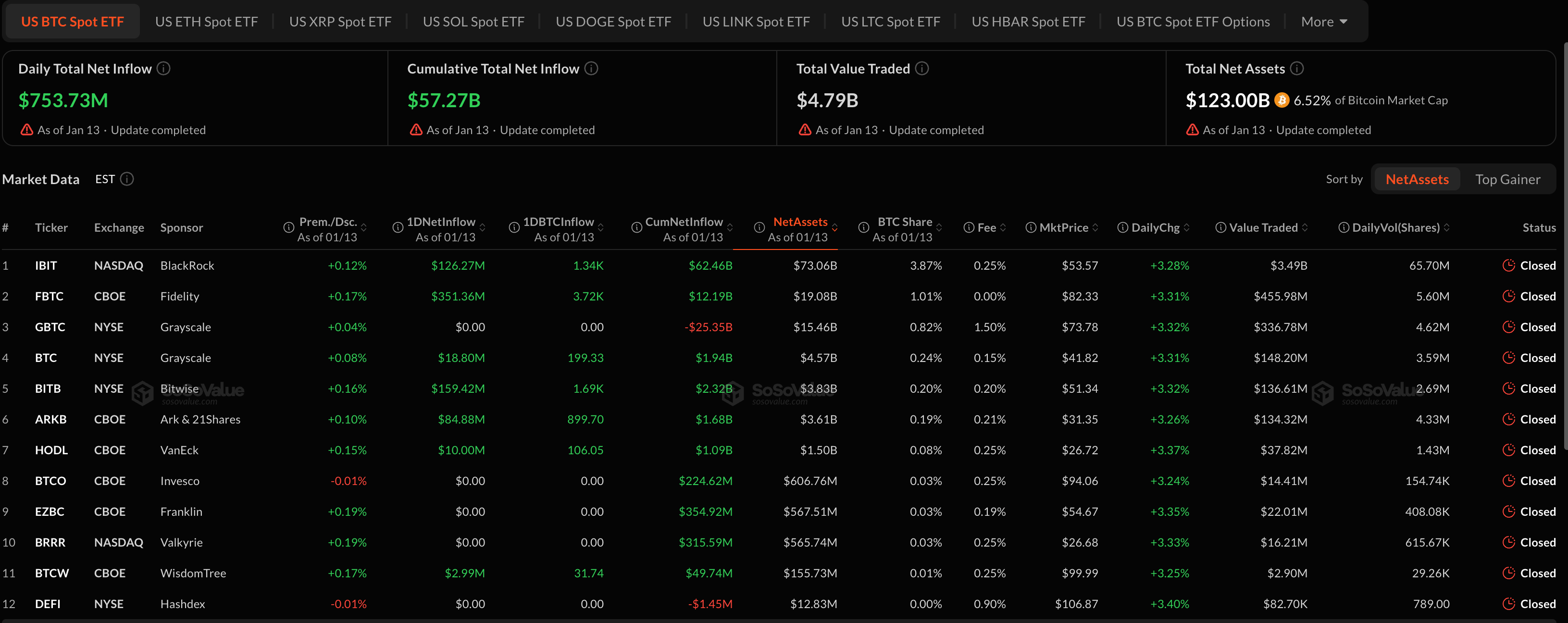

Data from SoSoValue shows spot bitcoin ETFs logged $753.7 million in net inflows, the strongest single-day total since Oct. 7. Fidelity’s FBTC led inflows with $351 million, followed by $159 million into Bitwise’s BITB and $126 million into BlackRock’s IBIT.

The pickup in flows suggests institutional investors are re-entering the market after a subdued end to 2025, when tax-related selling and risk-off positioning weighed on allocations to crypto-linked products.

Ether-linked funds also saw renewed demand. U.S. spot ether ETFs posted a combined $130 million in net inflows across five products, mirroring the broader recovery in crypto markets.

Improving macro signals helped underpin sentiment. The latest U.S. consumer price index data showed inflation continuing to cool from prior highs, reinforcing expectations that the Federal Reserve could pivot toward interest rate cuts later this year — a backdrop that has historically supported risk assets.

Crypto prices rose alongside the inflows. Bitcoin gained about 3% over the past 24 hours to trade near $94,600, while ether climbed more than 6% to around $3,320, outperforming as demand broadened beyond bitcoin.