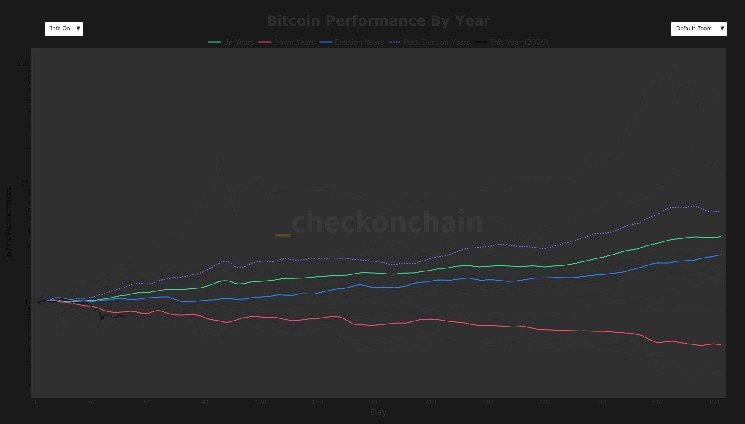

Alright, listen up, folks! If you’ve been keeping an eye on the crypto charts, you know things have been a bit of a rough ride for Bitcoin this year, and that’s straight up wild. According to data from Checkonchain, Bitcoin just logged its worst first 50-day start to a year on record in 2026. No cap, this ain’t just a minor dip; we’re talking about a significant slump that has many investors scratching their heads and wondering what the future holds for the OG cryptocurrency.

The numbers, dude, are kinda grim. Bitcoin is down a solid 23% year-to-date. January saw a 10% drop, followed by an even heavier 15% slide in February. For real, this back-to-back monthly decline is unprecedented; Coinglass data confirms that Bitcoin has never before recorded consecutive negative returns in the first two months of any year. While we’ve seen double-digit drops in January in years like 2015, 2016, and 2018, those periods were typically followed by a bounce-back February. If this trend holds, Bitcoin is also on track for its weakest consecutive monthly performance since way back in 2022, which was a tough year for everyone in the crypto space.

To put this into perspective, Checkonchain data reveals that in a typical down year, the average index reading after 50 days is around 0.84. Bitcoin is currently chilling at 0.77. This figure underscores the sheer scale of the current drawdown and highlights just how significant this slump is compared to historical patterns. What’s even more perplexing is that this weakness follows a pretty bleak 2025, which saw a 17% decline. Historically, post-election years have often tended to outperform election years and generally shown aggregate strength. This makes Bitcoin’s current underperformance, and its struggles in 2025, really stand out as a deviation from what we’d typically expect.

So, what’s the deal? Why is Bitcoin, the crypto king, having such a tough time? Well, it’s rarely just one thing in the wild world of digital assets. First off, let’s talk macroeconomics. The global economic landscape is still, for lack of a better word, a bit sketchy. Inflation, while perhaps not as rampant as before, remains a concern, and central banks, especially the Federal Reserve here in the U.S., are still playing a delicate balancing act with interest rates. Higher interest rates typically make riskier assets like crypto less attractive compared to safer, yield-bearing investments. When the cost of borrowing money goes up, investors tend to pull back from speculative plays, and Bitcoin, for all its innovations, is still seen by many as a speculative asset.

Then there’s the whole regulatory environment, which is always a big factor. Governments worldwide are trying to figure out how to best regulate crypto, and sometimes that uncertainty can cast a long shadow. Any talk of stricter regulations or outright bans in certain jurisdictions can send jitters through the market. We’ve seen how even the whispers of new policies can create volatility. On the flip side, positive regulatory clarity, like the approval of spot Bitcoin ETFs in some regions, can provide a significant boost, but those effects might be wearing off, or simply not enough to counteract the prevailing negative sentiment.

It’s also worth remembering that Bitcoin, while revolutionary, is no stranger to dramatic price swings. This isn’t its first rodeo, nor will it be its last. Its history is littered with massive bull runs followed by gut-wrenching bear markets. Think back to the epic highs of 2017 or 2021, and then the subsequent crashes. These cycles, often influenced by events like the Bitcoin halving (which reduces the supply of new Bitcoin), are part of its DNA. However, the current slump feels a bit different given the historical context of consecutive monthly declines and its deviation from expected post-election year performance. It signals a deeper underlying challenge or perhaps a broader shift in investor sentiment.

Investor psychology plays a huge role here, too. Tools like the “Crypto Fear & Greed Index” often give us a quick pulse check on the market. When the market is in a state of “extreme fear,” as it has been for stretches, people are more likely to sell off their holdings, further exacerbating declines. On the flip side, “extreme greed” can lead to irrational exuberance and bubbles. Currently, it feels like the fear factor is pretty high, keeping new money from flowing in with the enthusiasm we’ve seen in past bull cycles. Retail investors, who often drive significant momentum, might be feeling the pinch from the broader economic conditions, reducing their disposable income for speculative investments.

What’s next for Bitcoin? That’s the million-dollar question, for real. Many analysts are looking for catalysts that could turn the tide. A significant shift in the Federal Reserve’s monetary policy, perhaps an indication of future rate cuts, could inject some much-needed optimism into risk assets. Breakthroughs in the broader blockchain ecosystem, increased institutional adoption that’s legit and sustained, or even major geopolitical stability could all contribute to a recovery. But for now, investors are on heads up mode, closely watching every data point and macroeconomic indicator.

This rough ride for Bitcoin in early 2026 is a stark reminder that even the most established cryptocurrencies aren’t immune to market forces and historical deviations. While the long-term bullish case for Bitcoin often hinges on its scarcity and decentralized nature, the short-to-medium term can be, well, a roller coaster. It’s a true test of conviction for HODLers and a cautionary tale for those looking for quick gains. We’ll have to see if the crypto market can shake off these winter blues and get back to its usual dope self. For now, it’s a waiting game.

If you enjoyed this article, share it with your friends or leave us a comment!