Ark Invest founder Cathie Wood has recently shared forecasts on the US economy and crypto market, anticipating gains with Donald Trump’s return to the White House. She has highlighted potential shifts in regulatory leadership, such as in the US SEC and FTC, that could help innovation and economic growth. She also expects these developments to impact the digital assets sector as Wood’s projections go beyond crypto, with promising forecasts for equities and transformative technology sectors like robotics and AI as John Deaton criticizes SEC Chair and Senator over crypto regulation.

Cathie Wood Sees Potential SEC Restructuring Boosting U.S. Innovation

According to Cathie Wood’s post via X Space, the U.S. economy is expected to enter a new phase of growth driven by policy initiatives aimed at deregulation, spending cuts, tax reductions, and a focus on technologically enabled innovation.

https://x.com/CathieDWood/status/1855810266664984628

These measures are expected not only to improve traditional industries but also to influence the evolving cryptocurrency sector. If fully realized, this shift could surpass the economic transformation seen during the Reagan era and position the U.S. as a leader in crypto-related innovation.

Wood has suggested that new leadership at regulatory agencies like the SEC and the Federal Trade Commission (FTC) could unlock technological growth in the United States. This perspective aligns with ongoing market speculation, hinting at a possible departure of the current SEC Chair by the end of this year. During the Bitcoin Conference, Trump noted that he would sack Gary Gensler on his first day in office. She indicated that such regulatory changes might create favorable conditions for the cryptocurrency market, decentralized finance (DeFi), and other innovative sectors.

Wood further elaborated that deregulatory strategies might involve reducing the reach of the SEC while promoting technology development. These shifts, she argued, could enhance economic growth. Tax cuts, reduced government spending, and a focus on tech-driven innovation could collectively accelerate economic progress. This environment would likely foster growth in emerging sectors, including blockchain, artificial intelligence, and energy storage.

Drawing a comparison to the economic climate of the 1980s and 1990s, Wood referenced the thriving period of active equity investing during those decades. She predicted that implementing Trump’s proposed policies could lead to a similar surge in productivity for the U.S. economy. According to Wood, this scenario would support not only the growth of the crypto market but also stimulate broader economic prosperity.

Technological Innovation and Tax Cuts: A Boon for Blockchain and Crypto Investments

Tax reductions benefit not only traditional businesses and individuals but also crypto investors. Lower taxes may increase disposable income and investment capacity, providing individuals with more capital to allocate toward cryptocurrency portfolios. For companies involved in blockchain development, tax relief could reduce operational costs, enabling them to scale faster and allocate more resources to innovation. This policy could encourage greater participation in the crypto market, potentially fueling its growth as part of the broader financial system.

Technologically enabled innovation is a pillar of this policy shift that could drive growth in the cryptocurrency sector. Investments aimed at fostering new technologies include blockchain and related infrastructure. As the U.S. seeks to lead in digital finance and technological advances, support for emerging sectors like cryptocurrency may gain momentum. This emphasis positions the country to spearhead developments in digital assets, integrating them further into global financial ecosystems.

Crypto Growth Expected Under Potential Donald Trump Presidency

Cathie Wood, CEO of Ark Invest, has expressed optimism regarding the potential for enhanced support for digital assets, particularly Bitcoin, under a Donald Trump presidency. Wood has fueled speculation that Trump might design Bitcoin as a strategic reserve asset for the U.S., which could further boost its market appeal.

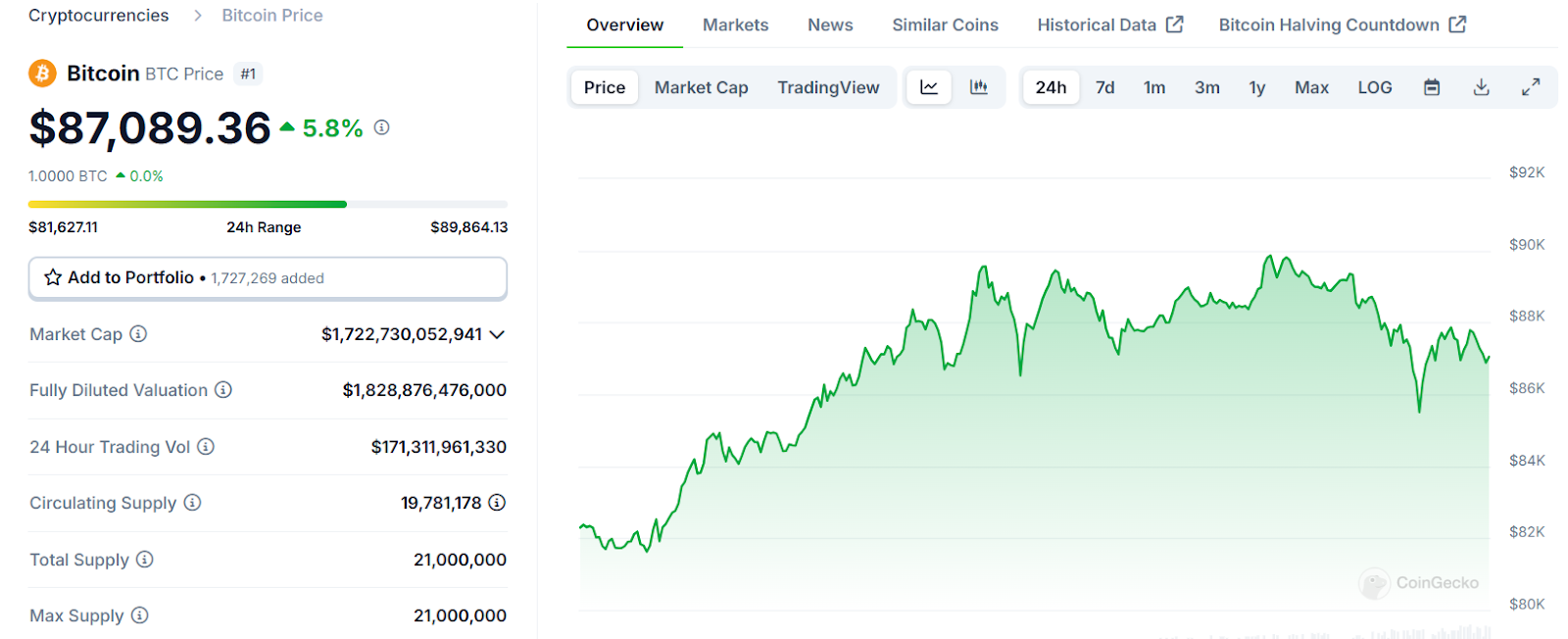

Coingecko data indicates that Bitcoin (BTC) trades at $87,089, reflecting a 5.8% increase in the past 24 hours. This marks momentum as Bitcoin continues an upward trend with an ATH record a few days after Trump’s victory.

Source: Coingecko

Wood has also conveyed confidence that a new administration would create a supportive environment for growth in blockchain, decentralized finance (DeFi), and related crypto segments. She has pointed out that this potential backing, combined with expected regulatory easing, could significantly increase productivity across various innovation-driven sectors, such as autonomous mobility, digital healthcare, and advanced manufacturing.

In her assessment, these emerging technologies could converge to drive substantial GDP growth, potentially positioning the U.S. as a global leader in innovation once more. Wood’s views align with broader market sentiments, anticipating an uptick in cryptocurrency adoption and valuations with a new administration at the helm.

Donald Trump has notably addressed cryptocurrency, particularly Bitcoin, during his campaign. Meanwhile, Wood also highlighted Elon Musk’s growing involvement in U.S. politics and how his proposed Department of Government Efficiency (D.O.G.E.) initiatives could contribute positively to the country’s economic future.

Furthermore, Wood’s sentiment is echoed by other market leaders. For instance, Charles Hoskinson, the founder of Cardano, recently expressed his willingness to assist the U.S. government in establishing clear regulatory frameworks for the crypto industry.

John Deaton Criticizes SEC Chair and Senator Over Crypto Regulation

Pro-XRP lawyer John Deaton has voiced his concerns about Senator Elizabeth Warren and Gary Gensler, Chairman of the U.S. Securities and Exchange Commission (SEC), via the X platform. Both public officials have been focal points of Deaton’s criticism, which centers on what he describes as an unfair regulatory crackdown on the crypto sector. Despite these challenges, Deaton expressed optimism for the industry’s future following recent political developments.

https://x.com/JohnEDeaton1/status/1856074772465234005

During the high-profile SEC vs. Ripple lawsuit, Deaton initially gained prominence by representing XRP holders. Over time, his advocacy expanded to highlight broader issues affecting the American crypto landscape. Notably, Deaton ran against Warren in a recent Massachusetts Senate race but was defeated, even as Donald Trump secured victory in the presidential election.

Despite this electoral outcome, Deaton remains vocal, emphasizing that American crypto investors are real winners. According to Deaton, entrepreneurs in the U.S. have long sought regulatory clarity. Instead, the crypto sector has encountered stringent measures that he believes have hindered innovation. He cited cases where firms like OpenSea, Uniswap, and Robinhood were issued Wells Notices, often leading to costly legal battles.

Economic Shifts and Industry Outlook

Deaton claims that this regulation-by-enforcement approach has pushed many crypto businesses overseas. However, with Trump set to assume office in January, he foresees significant changes.

His comments followed a post by Gemini co-founder Tyler Winklevoss, who pointed to Bitcoin’s recent surge past $85,000 as evidence of past regulatory impediments under Gensler and Warren. Winklevoss hinted at an impending “supersonic American economic boom” driven by new policies.