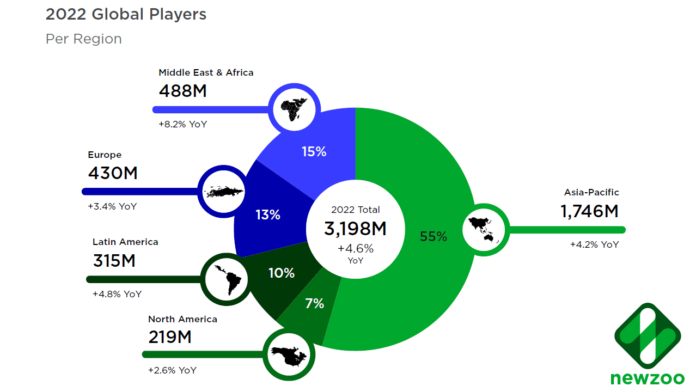

Nearly 3.2 billion people passed the time with a video game in 2022, up from 2.9 billion in 2020, according to the 2022 Global Games Market Report(Opens in a new window) from Newzoo, which says that number could top 3.5 billion by 2025.

“The past two years (2020 and 2021) saw not only record-level engagement and spending but also brought many new and lapsed players back to the pastime,” Newzoo says.

Despite the growth, however, 2022’s games market was down 4.3% to $184.4 billion. But that’s likely to be a simple corrective after the pandemic, when so many people were in quarantine with nothing else to do but play games and adopt pets. (Thankfully, most people are keeping their dogs and cats(Opens in a new window) to snuggle with while they game.) Inflation also plays a part.

The majority of players are in the Asia-Pacific region. North America is in fifth place with only 7% though it accounts for 26% of the market revenue, putting it second only to the Asia-Pacific area.

You can see the drop or growth in money making for each area of the globe; only Latin America and the Middle East/Africa will increase in 2022.

A lot of this hinges on mobile gaming. It makes up 50% of the market across the globe, accounting for $92.2 billion in revenue. The smallest slice of the gaming pie is now browser-based PC games—and that’s still a $2.3 billion business, for now.

The report’s authors posit that gaming is, to an extent, “recession-proof”—even with inflation and more people going outside, engagement with games is barely going to waver. Growth will come back even stronger as the economy improves. The expectation is that the gaming market will hit $211.2 billion by 2025, a growth of +3.4% CAGR (compound annual growth rate). This year is barely a setback. Add to this the fact that revenue growth from 2020 to 2022 was $43 billion higher than Newzoo predicted before the pandemic hit.

Recommended by Our Editors

The full report(Opens in a new window) has more, including the list of top public gaming companies by revenue (spoiler: Sony, Apple, and Microsoft are all in the top five, but are well behind China’s Tencent(Opens in a new window)). It also dives into the trend of opening up gaming ecosystems; Apple changing the mobile gaming world in 2021 with the Apple Tracking Transparency privacy rollout; and how in-game advertising is helping AAA game makers(Opens in a new window) make up for a decline in in-app purchases.

It’s a long report, and we only read the public, free version—you can pay for the 165-page full version if you want even more detail on the market.

The Best Gaming Laptops for 2022

The Best Gaming Laptops for 2022

Get Our Best Stories!

Sign up for What’s New Now to get our top stories delivered to your inbox every morning.

This newsletter may contain advertising, deals, or affiliate links. Subscribing to a newsletter indicates your consent to our Terms of Use and Privacy Policy. You may unsubscribe from the newsletters at any time.

Hits: 0