Hedera’s native token, HBAR, has suffered a 26% decline this month, reversing a bullish flag pattern. This price action has delayed expectations of a new all-time high.

The broader crypto market’s bearish cues have further weakened HBAR’s momentum, turning traders skeptical about a near-term recovery.

HBAR Traders Are Switching Their Stance

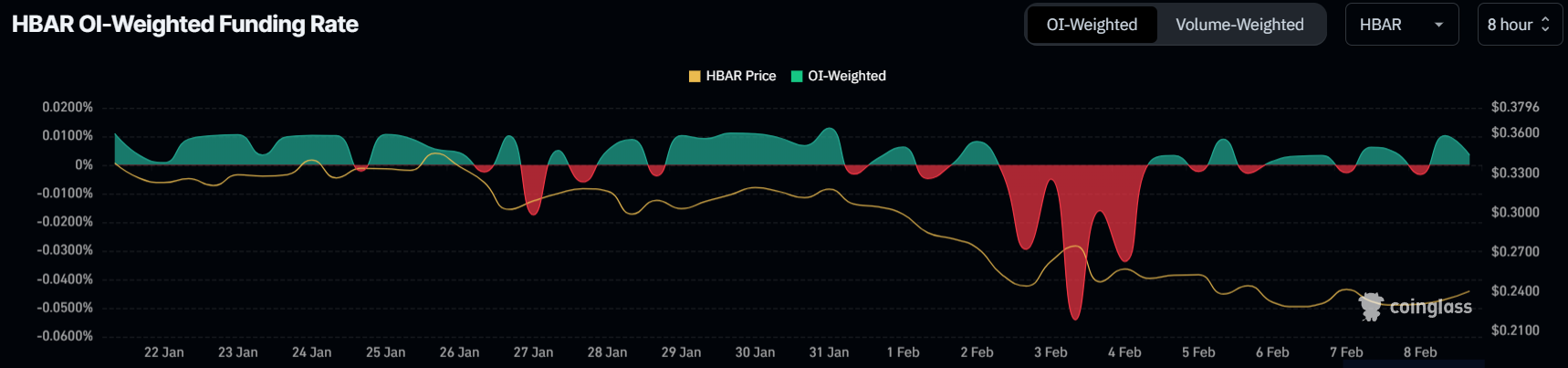

HBAR’s funding rate has been fluctuating between positive and negative over the past few days. This indicates that traders remain uncertain about the token’s future price direction. As a result, many are adjusting their positions to capitalize on volatility rather than making directional bets.

The inconsistent funding rate reflects a lack of confidence in an immediate recovery. With traders unwilling to commit to long positions, HBAR could struggle to regain momentum.

Until sentiment shifts toward a more bullish outlook, price movements are likely to remain unpredictable.

HBAR Funding Rate. Source: Coinglass

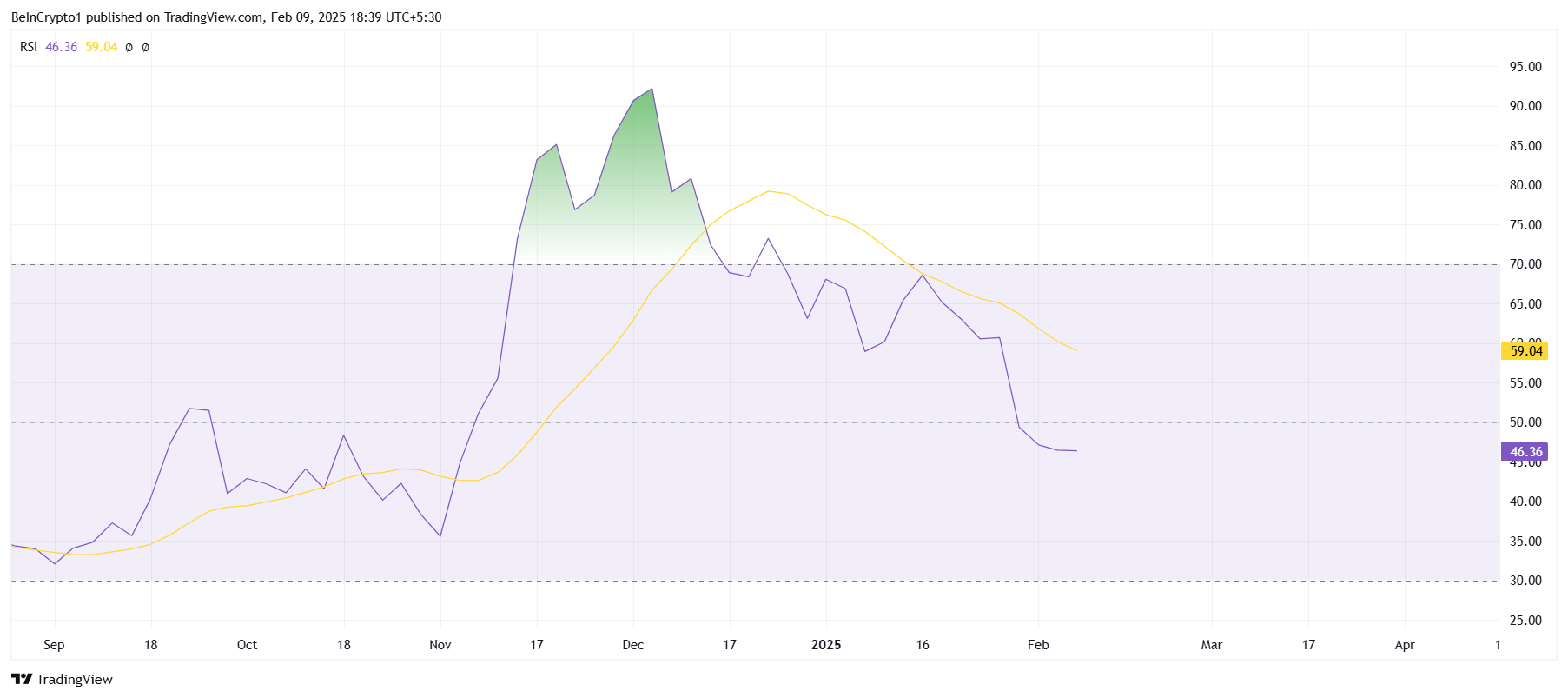

HBAR’s Relative Strength Index (RSI) has dropped below the neutral 50.0 mark, reaching a three-month low. This decline suggests that bearish momentum is gaining strength, increasing the likelihood of further downward pressure on the token’s price.

When the RSI trends downward, it typically signals weaker buying interest. If HBAR remains below this critical threshold, the altcoin may continue facing bearish sentiment.

Without a clear reversal in momentum, any potential recovery could be delayed, reinforcing the negative market outlook.

HBAR RSI. Source: TradingView

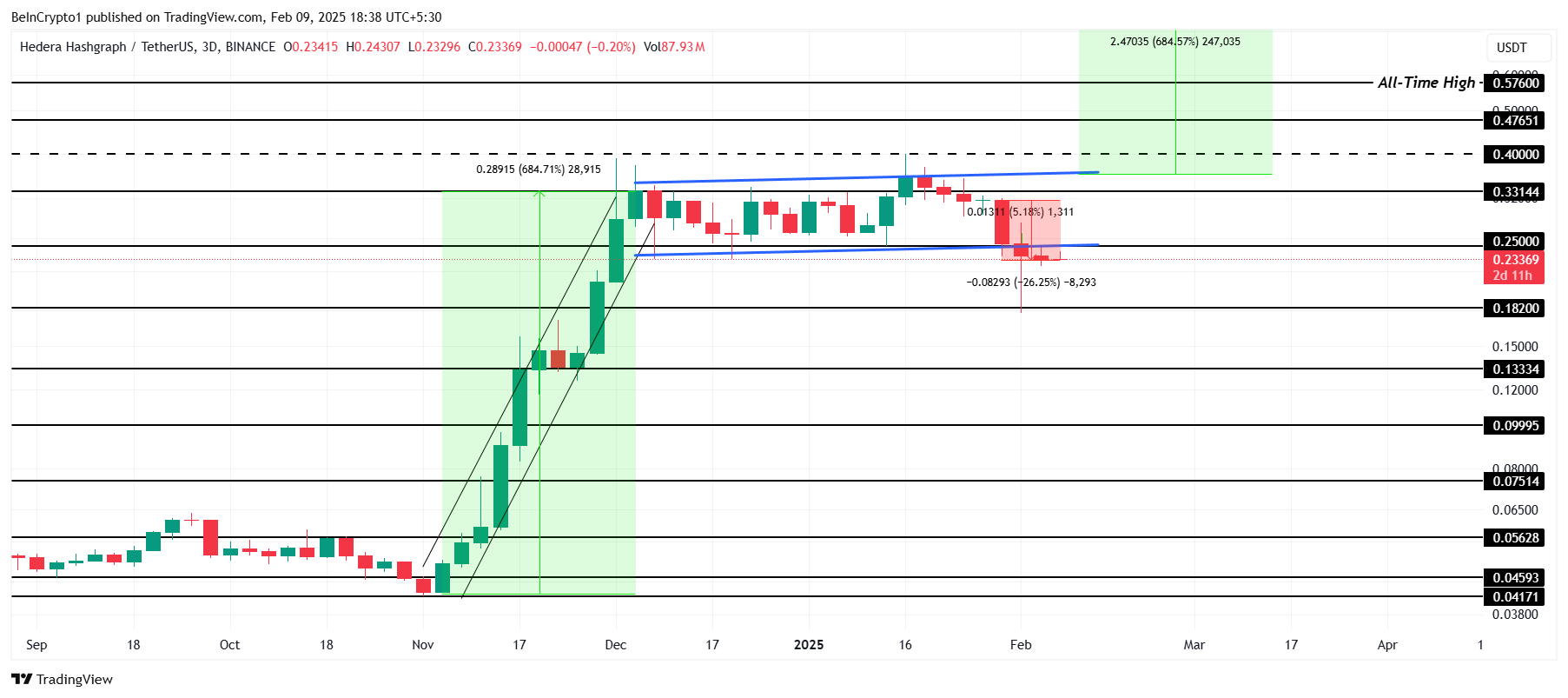

HBAR Price Prediction: Reclaiming Lost Support

HBAR has been on a sustained downtrend, losing over 20% of its value since the start of 2025. This decline has extended the bearish momentum that began in mid-January. The altcoin also fell out of the bullish flag pattern, which previously suggested a potential rally to its all-time high of $0.57.

Given current conditions, further downside appears more probable. If selling pressure persists, HBAR could drop to $0.182. This decline would erase a portion of the profits gained by investors between November and December 2024, when HBAR surged by 684%.

HBAR Price Analysis. Source: TradingView

However, a recovery remains possible if HBAR reclaims support at $0.25. Flipping this level could signal a shift in sentiment, allowing the token to regain lost ground.

If the altcoin successfully breaches the $0.33 resistance, it would invalidate the bearish outlook and restore confidence in its long-term bullish potential.