This week, the team of Pods, a provider of structured products for crypto assets, unveiled its latest offering – the ETHphoria Vault. This innovative yield strategy is designed explicitly for ETH enthusiasts who are bullish about its future prospects and want to earn even more from increasing prices.

ETHphoria is a low-risk, principal-protected strategy designed for those bullish on the ether (ETH) market. By integrating Lido with call options, ETHphoria allows users to earn higher rewards as the market rises.

The strategy uses 100% of Lido’s weekly staking rewards to purchase call options with a 1-week expiry. If the price of ETH or stETH rises above the strike of those call options within a week, the call options are exercised, resulting in profits for depositors.

Pods has a hybrid on-chain / off-chain approach, where the principal remains on-chain, and the yield can have the optionality to build the derivatives part off-chain.

With this approach Pods has the best of 2 worlds: on-chain security for the principal, and off-chain liquidity for the yield, resulting in better returns for the end user.

“At Pods, we recognize the importance of consolidating a single strategy into one token, not only for enhancing DeFi composability but also for user convenience. Our users can seamlessly transfer deposits between addresses, utilize them as collateral on other protocols, and easily verify their holdings in a specific strategy. I strongly believe in the power of the simplicity of this approach.”

– Rafaella Baraldo, CEO & Ci-Founder of Pods

Furthermore, the vault provides access to intricate strategies with a single click, withdrawal at any point after processing the deposit, and display of actual historical returns among other features. ETHphoria vault is live on mainnet: https://app.pods.finance.

ETHphoria leverages Lido, a leading decentralized staking protocol for ETH, to generate high yields. With a TVL of over $11.8 billion, Lido is a trusted choice for the DeFi community.

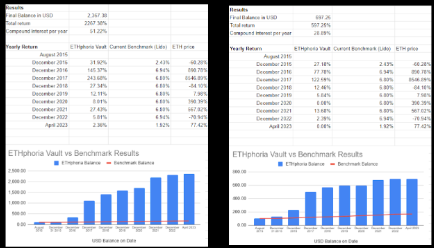

As ETHphoria evolves, Pods will continuously improve the vault’s functionality, you can check all the details in the Pods´ blog post by Rafaella. Pods´ blog readers can check the backtest of this strategy and how it would have performed if it were available when ETH started in 2015 until the present.

The vault has undergone four audits by audit firms including Open Zeppelin, ABDK, Number3, and Number4. Audit reports are available here.

Further, the Pods Yield product went through a review with DeFi Safety where it received a 97% score. You can find the detailed report at Pods Finance – detailed report | DeFiSafety.

Hits: 0