Solana Struggles Below $150 as Bears Maintain Control

Solana is facing significant selling pressure, struggling to break above the $150 mark as bears dominate price action. The broader market sell-off has taken a heavy toll on SOL, with meme coins experiencing some of the steepest declines. Solana, which previously benefited from the meme coin hype cycle, is now seeing a major pullback as speculation fades.

The price action remains weak as Solana trades below key demand levels that once sustained its long-term bullish structure. Bulls have lost momentum, failing to establish a strong recovery, while bears continue to drag the entire market down. If SOL fails to hold above current demand levels, further downside could be expected in the short term.

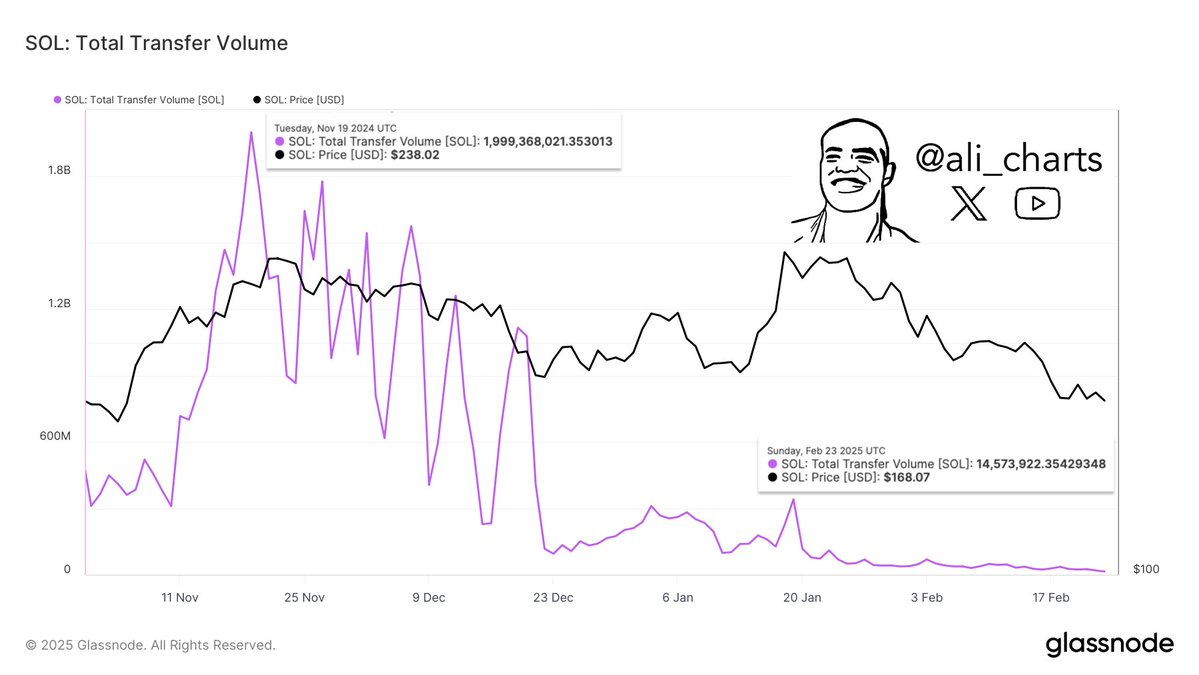

Martinez’s on-chain data highlights a troubling trend for Solana’s network activity. According to Glassnode, Solana’s transfer volume has plummeted from $1.99 billion in November 2024 to just $14.57 million today. This dramatic drop indicates a sharp decline in network usage and trading activity, further reflecting the cooling-off period in meme coin speculation.

The coming days will be critical for Solana. If SOL can hold above key demand levels, a recovery phase could begin. However, continued weakness in volume and price action could lead to further declines, making it essential for bulls to reclaim momentum soon.

Price Struggles At $140 Amid Selling Pressure

Solana (SOL) is trading at $141 after experiencing days of intense selling pressure, struggling more than most altcoins in the current market downturn. The broader crypto market has faced extreme volatility, with many assets seeing sharp declines. However, Solana remains one of the worst-hit, failing to establish strong support or momentum for a potential rebound.

If bulls can defend the $140 level, there is a chance for a short-term recovery. Holding above this crucial demand zone could provide the foundation for a push back above key resistance levels. However, sentiment remains weak, and any further downside in Bitcoin or the broader market could send SOL into deeper corrections.

If Solana fails to maintain its current support, the next critical level to watch is $130, where buyers may attempt to step in again. However, a sustained breakdown below this mark would increase the risk of further declines into lower demand zones. The coming days will be crucial for Solana’s price action, as investors wait to see whether bulls can reclaim momentum or if bears will continue to drive the price downward.

Featured image from Dall-E, chart from TradingView