-

Metalpha had dumped another 22,000 ETH worth $51.16 million to Binance.

-

Ethereum price could soar to the $2,570 and $2,800 levels if it closes a four-hour candle above the $2,400 level.

-

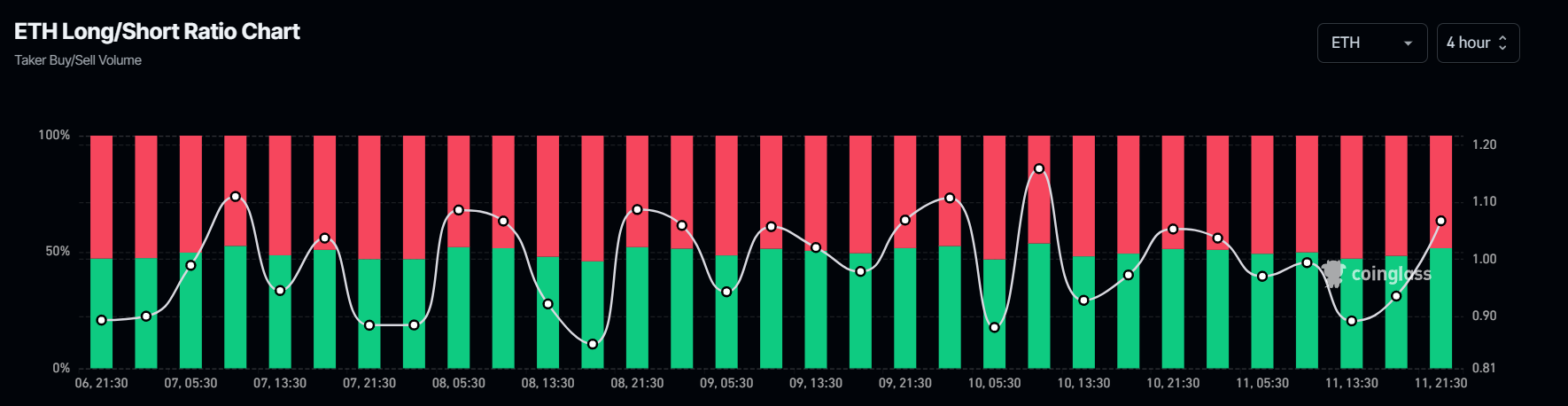

ETH’s Long/Short ratio currently stands at 1.067 in a four-hour time frame, indicating bullish market sentiment.

In the ongoing choppy cryptocurrency market, Metalpha, a giant asset management firm based in Hong Kong, is gaining significant attention from crypto enthusiasts due to its continuous Ethereum (ETH) dump. On September 11, 2024, the on-chain analytic firm TheDataNerd made a post on X (previously Twitter) that Metalpha had dumped another 22,000 ETH worth $51.16 million to Binance.

Metalpha Dumps $51 Million Worth of Ethereum

Investors and traders are curious about Metalpha’s recent transactions, as they have moved a substantial ETH in the past week. According to the data, the firm has offloaded a significant 56,188 ETH worth $130.81 million to the Binance.

As of now, ETH’s Relative Strength Index (RSI) is there in oversold territory, indicating a potential trend reversal from a downtrend to an uptrend.

Bullish On-chain Metrics

This bullish outlook is further supported by on-chain metrics. Coinglass’s ETH Long/Short ratio currently stands at 1.067 in a four-hour time frame, indicating bullish market sentiment. However, 51.84% of top ETH traders are holding long positions, while 48.16% are holding short positions.

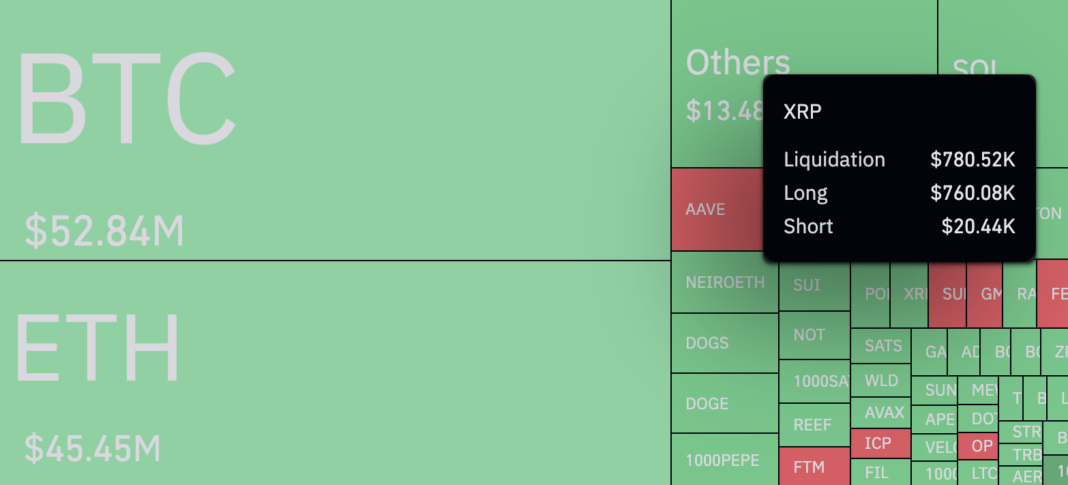

Currently, this data suggests that bulls are dominating the assets and have the potential to liquidate short positions.